It is amazing to us at Electronic Money Company, how many merchant service providers think up new fees and sneak them in under the radar in small print on a merchant statement! Many merchants don’t even look at their merchant statements because they don’t take the time to read the details every month, or because they have bookkeepers whose job is not management of money, … Read More

Inventory Shrinkage Beware!

How to protect your restaurant against food theft. Waiters can hurt your profit margins in a variety of ways, and rarely is restaurant theft as simple as taking from the cash register, or not ringing up an order and pocketing the money. Working around food all day can tempt even the most honest employee. I mean restaurant employees get hungry too. But they can also … Read More

Waiter Theft Scam in Restaurants – Why You Need the Right POS!

Sometimes waiter theft is planned and sometimes it is merely an oversight that ends up costing a restaurant owner money leaking from his bottom line. For example, the “Soda Pop Game” is a planned waiter scam to move money from the restaurant owner to his own pocket. “Beverage Amnesia” is an oversight when the restaurant gets slammed. The Infamous “Soda Pop Game”! This employee theft … Read More

PayPal vs Your Own Merchant Account

If you own a business, your customers must be able to pay for your goods or services using credit cards. To enable you to accept credit cards, you will need a merchant account, or you can opt to use a third-party processing service such as PayPal. PayPal is what is called aggregate processor, which means they lump all their merchants into one merchant account. One … Read More

Liquidated Damages

Liquidated Damages in a Credit Card Processing Agreement The Most Costly of Termination Fees Period! When you choose a credit card processor, you will be asked to sign a merchant services agreement that includes a commitment of between three and five years. In some cases, breaking a merchant services agreement early will simply result in a termination fee. But beware of credit card processing providers … Read More

Attention Roofers! Here’s How to Choose a Credit Card Processor for Your Roofing Business!

Some roofers choose not to take credit cards for their roofing jobs, and want everyone to pay with a check. However, not everyone has enough cash in their checking account to cover the roofing job. If you don’t take credit cards, you can lose business to a roofer who does take cards. Secondarily, taking credit cards offers a trust factor for your customers. They know … Read More

Visa Announces New Rules for Merchants Accepting Credit Card Refunds

Visa is introducing an authorization requirement for return (cardholder refund) transactions. Authorizing a return enables the card issuer to validate the cardholder account, decline potentially fraudulent cards, and minimize chargebacks if the account does not exist or is closed. The return authorization message is intended to improve the return process by enabling cardholders to view a credit/return on their online banking statement in real time, … Read More

Keep Clients with Your Bank

How a Good Merchant Services Program Keep Clients with Your Bank Is your current processor for merchant services shrinking your residual income and causing your clients to put their deposits into another bank? A good merchant services program should not only keep your merchants with your bank forever, but grow your portfolio of merchants doing their card processing with you as well. So how does … Read More

Restaurant Scams and Shams – A ‘Comps’ Tale

Last Father’s Day, I stole $100 from a local restaurant. I didn’t wear a ski mask and wave a pistol in the cashier’s face. I didn’t break into their safe during the dark, dark night. I didn’t have to do anything that dramatic. In fact, it was like taking candy from a baby. Now, before you start thinking you’re reading a report written by a … Read More

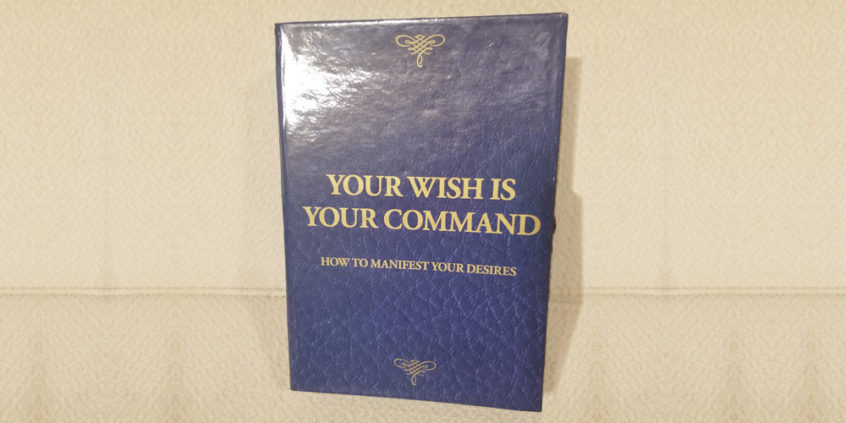

Back From an Event with My International Success Club!

I recently had the pleasure of attending another event with the success club I belong to. It is called the Global Information Network. We study together the principals of Napoleon Hill. We practice the teachings of Dale Carnegie in How to Win Friends and Influence People. We share with each other the books by Esther and Jerry Hicks, more specifically, Ask and It Is Given. … Read More