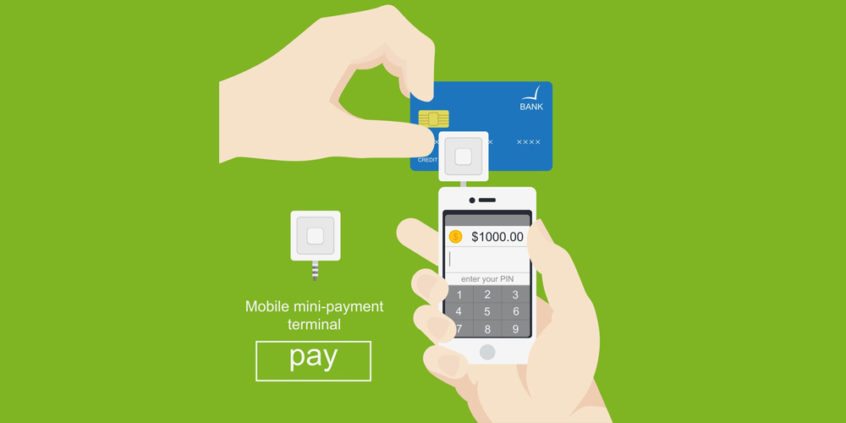

Small Businesses say Square is Holding Their Money!

Quoted from a New York Times article: “Thousands of small enterprises that use Square to process their credit card transactions — including plumbers, legal consultants and construction firms — have complained that the company recently began holding back 20 to 30 percent of the money they collected from customers. The withholdings came with little warning, they said, and Square asserted the right to hang on