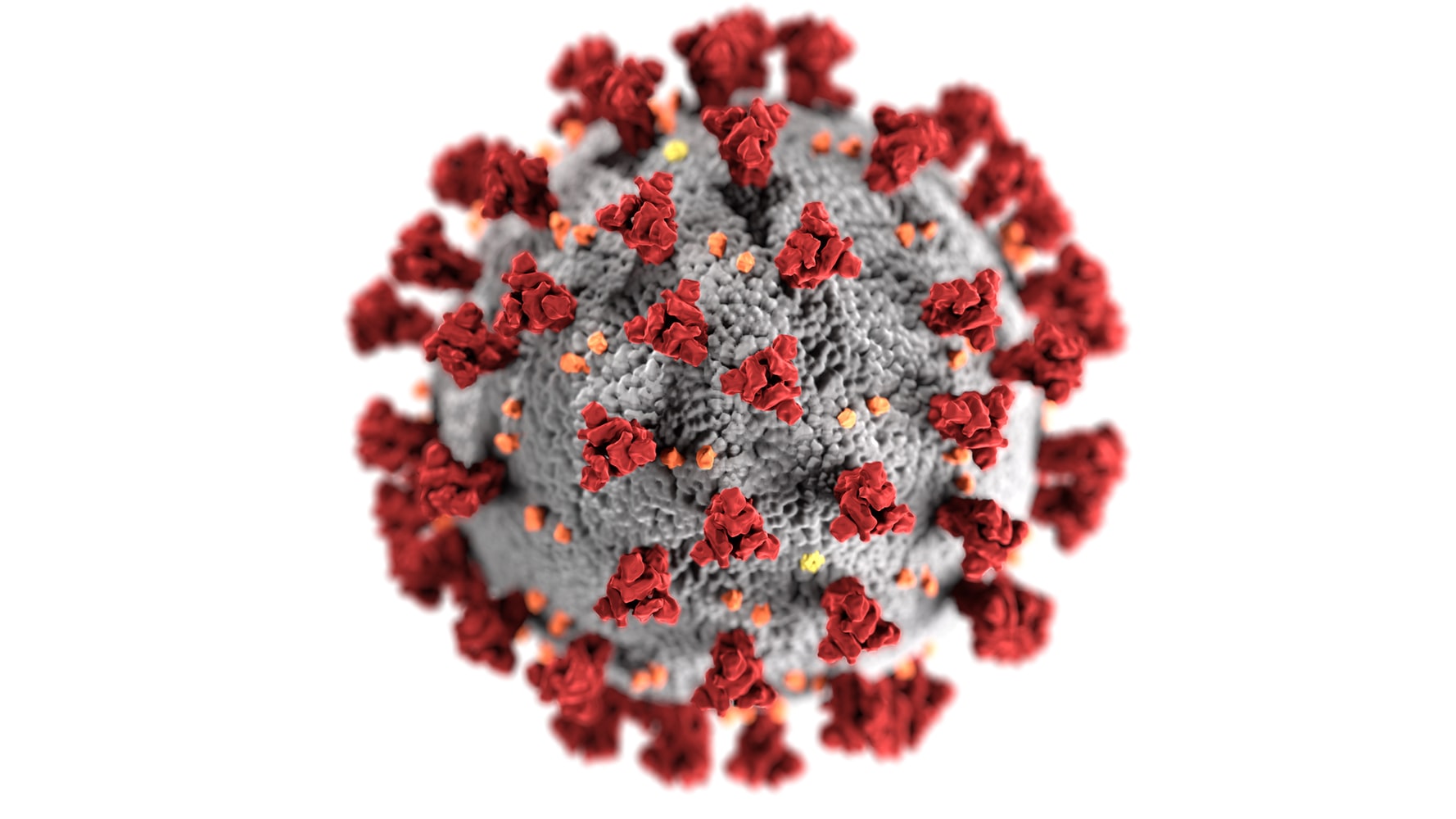

Advice on Growing Your Business While You Prevent the Spread of Coronavirus!

Paper money carries germs. How many people have touched that $1 bill that you just received as change? Using your credit or debit card limits touches to non-sterile paper money and limits exposures to viruses, especially the Coronavirus, which lives on inanimate objects for up to five days. Here are some small ways that merchants and consumers can use best practices to help prevent the