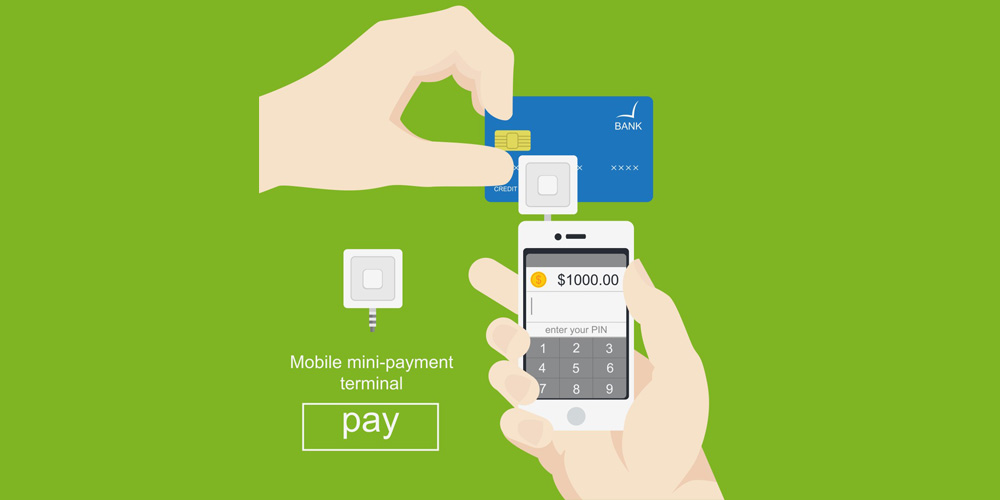

Payment Processing Moves From Terminals Into Tablets!

Payment Processing Moves From Terminals Into Tablets! As technology changes the world around us, so it changes how we process credit card transactions. When we first got in this business 20 years ago, the big news was pin debit. Then e-commerce gateways were introduced followed by mobile payment processing. Terminals were always in big demand until recently, when card processing got moved inside an app